Torrent Capital (“Torrent” or “the Company”) is pleased to update shareholders on its performance during 2023, and its plans to deliver shareholder value in 2024 and beyond. Our business model evolved in 2023 since the formation of Argentia Capital Inc (“ACI”), a company jointly owned with the Port of Argentia Inc. (“POA”) in Newfoundland. There are two key pillars to Torrent’s growth strategy, outlined below.

- Actively managed investment portfolio of small cap growth equities.

- Joint venture with the Port of Argentia Inc: Argentia Capital Inc.

Argentia Capital Inc. is a 50/50 joint venture between Port of Argentia (“the Port”) and Torrent Capital. The Port is looking to host the production of green hydrogen derivatives for export to international markets. Pattern Renewable Holdings Canada 2 ULC (“Pattern Energy”) is undertaking the feasibility, environmental and permitting work necessary to establish Argentia Renewables, a 300-megawatt wind energy to green hydrogen production project at the Port.

Through ACI, Torrent Capital is investing in developmental projects at the Port, resulting in opportunities to earn royalty revenues and equity positions in the projects. ACI has negotiated an opportunity to invest in Pattern’s proposed renewable energy green fuels project (“the Project”). Commercial terms will see ACI receiving a royalty calculated as a percentage of gross revenue on sales of ammonia at rates ranging from 1% to 3.5%, depending on the market price of ammonia. In addition, ACI has the right to acquire up to a 12.5% limited partner equity interest in the Project, or any other entities established for maintaining and operating renewable energy green fuels production, storage, and exports at the Port.

Phase 1 of the Project involves the installation of 300 MW of wind power on lands privately owned by the Port of Argentia. A hydrogen/ammonia plant will be located at the Port in close proximity to POA’s marine terminal. These facilities will produce hydrogen through an electrolysis of water using renewable wind energy. The Project is expected to produce 400 metric tonnes per day (MTPD) of green ammonia (146,000 tonnes of ammonia per year), and project commissioning is targeted for late 2027. The Project could potentially be scaled up in a second phase to more than one gigawatt of renewable energy producing approximately 1,400 MTPD of ammonia. ACI’s involvement in this venture highlights its efforts to work with the Port in fostering innovative projects with substantial long-term benefits.

Torrent’s 50% joint venture interest in Argentia Capital Inc. is expected to create significant value for shareholders through the royalty rights and potential equity interests in projects.

Torrent Portfolio Performance

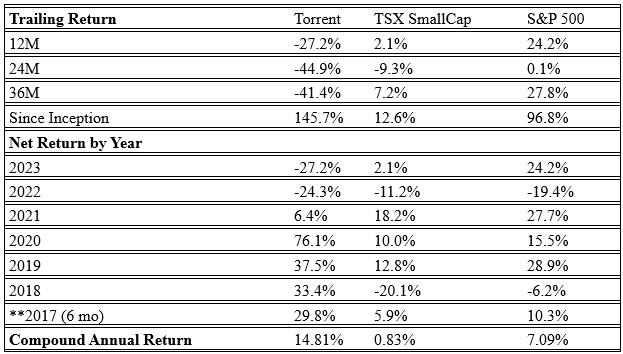

Since inception in mid 2017, Torrent has outperformed the benchmark S&P/TSX Small Cap index and the S&P500. As of December 31, 2023, Torrent’s NAV had a compound annual growth rate (“CAGR”) of 14.81%, compared to the benchmark S&P/TSX Small Cap index’s CAGR of 0.83%, and the S&P500’s CAGR of 7.09% during the same period. The bulk of Torrent’s outperformance was during the four-year period from Torrent’s inception in mid 2017 through to the end of 2021.

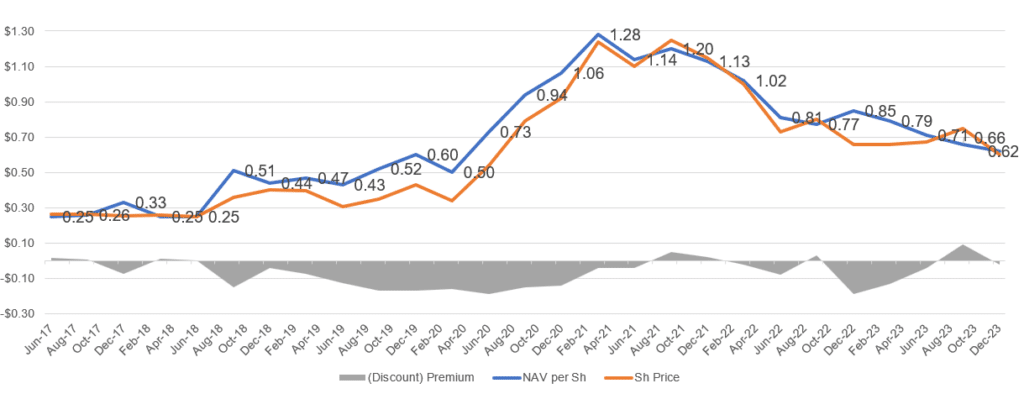

Since early 2022, Torrent’s portfolio experienced high volatility and contraction. Torrent recorded a down-year in 2023 with Net Asset Value (“NAV”) per share as of December 31, 2023, declining to $0.62, a change of -27.2% compared to the prior year end value of $0.85 per share. Despite consecutive down years, the cumulative return of Torrent’s portfolio since inception was 145.7% as of December 31, 2023. While 2023 was a challenging year for the portfolio for reasons outlined in the commentary below, we are optimistic about 2024. There has been a recovery in key portfolio holdings in Q1 2024 and the potential benefits of our ACI investment are becoming apparent.

Torrent Capital Net Asset Value per share (blue) and Share Price (orange) since inception

Analysis of Core Portfolio Holdings

Kneat.com Inc (TSX: KSI)

Kneat revenues grew considerably through 2023, reporting Annual Recurring Revenue (“ARR”) of $37.4M as of December 31, 2023. This growth represents an increase of 55% year over year, and 19% sequentially from $31.4M at September 30, 2023. We believe Kneat is in the early stages of its scale up phase. Kneat’s ARR continues to grow at a strong pace with margin expansion and little customer churn. Their net revenue retention rate (“NRR”), which reflects the expansion of ARR by customers using the software platform at the start of the year, was 138% for the year ended December 31, 2023. This NRR metric significantly exceeds industry averages and demonstrates Kneat’s ability to retain its customer base as they expand their use of the software. Gross margin in the fourth quarter of 2023 was 72%, compared with 63% for the fourth quarter of 2022. We anticipate Kneat’s operating cash flows will improve through 2024 as margins continue to expand and expense growth is curtailed.

Over the course of 2023, Kneat added eight additional multinational customers. It is worth noting that Kneat’s customer base has diversified beyond pharmaceutical companies, thus increasing their total addressable market. Of the new customers landed, three are global health care companies; two are contract distribution and manufacturing organizations; two are pharmaceutical companies; and one is a global consumer health company.

Kneat strengthened its balance sheet with the closing of an equity raise of $20M in February 2024, which we believe will sustain the company until profitability is achieved. Kneat is a core holding and one of our largest positions. We remain confident that significant growth potential remains for Kneat and plan to hold the position for the long term.

Electrovaya Inc. (Nasdaq: ELVA)

Electrovaya is a leader in lithium-ion battery technology for heavy duty electric vehicles, materials handling, and energy storage markets. Torrent initiated a position in Electrovaya in 2020 after identifying the company as a leader in the Canadian energy storage sector. Since then, Electrovaya has landed and expanded deals with top tier Original Equipment Manufacturers (“OEMs”), up listed from the TSX to the Nasdaq, and grown annual revenue from USD $16.3M in FY2020 to $44.1M in FY2023.

The Company announced the launch of its Infinity-HV battery systems in 2023, which we forecast will position Electrovaya for future growth. The Infinity-HV systems target heavy-duty, high-voltage applications including buses, trucks, hybrid-fuel cell/battery systems and stationary energy storage systems. First shipments of this new product offering were made to an undisclosed global aerospace and defense company in mid 2023. With the successful roll out, Electrovaya expanded its total addressable market considerably, creating new avenues for growth alongside its successful materials handling batteries. Through 2023, Electrovaya expanded orders from existing clients and landed a strategic supply agreement with a new OEM, diversifying its revenue base and pipeline.

Despite the improvements in revenue, EBITDA and margins, ELVA’s share price has been range bound since its Nasdaq up-listing. Since 2021, Electrovaya’s share price faced valuation multiple contraction along with the rest of the clean technology sector, leading to underwhelming share price performance through 2023.

Electrovaya 2023 corporate highlights (fiscal year ended September 30, 2023)

• Revenue for FY 2023 was $44.1M, from $16.3M in FY 2022

• Adjusted EBITDA was $3.2M, up from negative $3.5M in FY 2022

• Trading commenced on Nasdaq under the symbol ELVA

• Continued progress towards developing its Gigafactory in Jamestown N.Y.

Torrent plans to remain invested in ELVA through 2024.

WildBrain Ltd. (TSX: WILD)

Wildbrain was the most significant contributor to Torrent’s NAV decline during 2023. The year brought challenges to the media industry that Wildbrain faced head on. Dual labour strikes impacted the content industry and led to an industry wide slow down for media producers across Canada and the US, and thus reductions in content production at the Wildbrain studios in Vancouver. In the aftermath of these labour strikes, their studio workers in Vancouver unionized. The slowdown lasted longer than initially forecasted which weighed on WILD’s share price through the year, and financial projections were revised downward. Now that the labour issues have been resolved, Wildbrain management stated that their outlook for FY2025 and 2026 is strong and pipeline visibility is improving. We believe the company has turned the corner now that the industry wide labour challenges are resolved, and studio production is slowly ramping up again.

One of Wildbrain’s stated priorities for 2024 is to reduce leverage ratios, which may be accomplished by selling non-core assets to pay down debt, with a view to generating proceeds of $100-300M.

2023 Financial Highlights (fiscal year ended June 30th, 2023)

- Revenue grew 5% year over year to $532.9M

- Net loss was $45.6M, compared with net income of $5.6M in 2022, primarily driven by a non-cash impairment charge of $33.2M

- Adjusted EBITDA grew 10% to $97.9M

- Cash provided by operating activities was $94.2M, compared with cash provided of $33.1M in 2022.

- Free cash flow was positive $29.8M, compared with negative $17.4M in 2022.

Wildbrain’s share price is trading near multiyear lows. As content production picks up again and balance sheet leverage is reduced, cash flow margins can be expected to improve and Wildbrain will be positioned to return to growth and generate increased value for shareholders.

AnalytixInsight Inc. (TSXV: ALY)

A significant contributor to Torrent’s underperformance in 2023 were realized losses incurred upon exiting a position in AnalytixInsight Inc. The loss was realized in the fourth quarter of 2023 as we disposed of our position. It became clear that ALY’s technology and market potential was less compelling than previously indicated by management. This ultimately led to precipitous decline in ALY’s share price. Torrent admittedly made the wrong call by investing in this company.

Resource Exploration Portfolio

Torrent’s resource exploration portfolio also weighed on performance through 2023. The TSX Venture Metals & Mining index had an underwhelming performance of -9.38% through 2023, highlighting the market wide contraction in the Canadian exploration sector. [1] The outlook for 2024 is more positive as commodity prices have been strengthening recently. Gold bullion prices recently surpassed all-time highs and junior mining and exploration companies are trading more constructively. We anticipate that commodity prices will remain buoyant in 2024 as interest rate cuts are anticipated towards the end of the year. In our view, the recent rise in gold prices is not yet reflected in the current valuations of gold mining companies. While Torrent maintains exposure to the mining and exploration sector, through the year, we took measures to reduce certain underperformers to reinvest in opportunities with more favourable risk adjusted return potential.

10 Year Gold Price

Market Commentary

As major US market equity indices rebounded in 2023, Canadian markets lagged considerably behind. This is especially true for the small cap sector. The TSX Venture Composite index declined 3.1% in 2023 and remains down nearly 50% since February of 2022. [2] The TSX composite index climbed 8% in 2023, but also significantly underperformed major US equity indexes. [3] During 2023, the S&P 500 returned 24.2% and the Nasdaq Composite Index returned 43.4%; both indexes surpassed all-time highs through Q1 of 2024. The divergence in performance between the Canadian and US indices is significant. In our opinion, the divergence is due to a variety of factors, including:

- Significant weighting of high growth, large cap technology stocks in major US Equity indexes, including the ‘magnificent 7’ stocks: Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla

- Canada’s dependence on natural resource companies and exploration, sectors that have been out of favour for several years.

Comparison of S&P500 (Blue), TSX index (Green), and S&P/TSX SmallCap index (red) over 10 years

The effect of interest rates on speculative investments

The TSX Venture Exchange and a significant portion of the TSX are comprised of speculative and small cap companies with uncertain cash flows in comparison to the S&P 500 and Nasdaq Indices. In the prior low interest rate period that lasted to the end of 2021, investors directed capital from low return, safer equities into more speculative early-stage companies, thus taking on heightened levels of risk in an attempt to seek returns above the market interest rate. Early-stage companies experienced heightened capital flows and valuations, and risk was often disregarded. Excessive valuations were common, and the situation was proven to be unsustainable. Legendary investor Howard Marks outlines this concept in his latest memo, when discussing the impact of low interest rates: [4]

“The return increments associated with longer-term, riskier, or less-liquid assets can become inadequate to fully compensate for the increase in risk. Nevertheless, the low prospective returns on safe securities cause investors to look past these factors and lower their standards, encouraging speculation and causing questionable investments to be made in pursuit of higher returns.”

Source: ‘Easy Money’ – memo by Howard Marks

With the rising interest rate environment that began in 2022, a higher discount rate has been applied to future cash flows and valuations have compressed considerably. Small and micro-cap equities have been hit with the most severity as capital shifted back to larger cap equities and safer investments. Capital flowed out of the Canadian small and micro-cap markets thus contributing to Canada’s underperformance.

Canada’s dependence on old economy sectors

The TSX and TSX-V stock exchanges are home to 40% of the World’s publicly listed mining companies, more than any other exchange in the World. The materials and energy sectors combined account for 60% of the companies on the TSX Venture Exchange and 27.5% of the TSX, yet only 6% of the S&P 500.

The TSX Venture metals and mining index had a return of -2.02% over the last 10 years, despite one of the greatest stock market rallies in history during this period. The energy (oil and gas) sector performed similarly in Canada, with the S&P/TSX Composite Energy sector index returning only 3.48% over the last decade. Meanwhile, the S&P500 appreciated by over 175% the past decade.

Torrent’s Plans for 2024

Below, we detail Torrent’s investment strategy and core investment principles that will guide our decisions through 2024 and beyond. Our philosophy is centred on identifying opportunities with potential to provide high risk-adjusted returns. In other words, Torrent invests in companies in which the upside outweighs the potential risks. We endeavor to find companies with disruptive technologies that have realistic potential to capture and disrupt large markets. We sometimes take concentrated positions in such companies where we believe growth potential has not yet been fully priced in.

When opportunities present, we participate in special situations and catalyst driven strategies with shorter time horizons. This may include event-driven strategies or short-term trading tactics.

We anticipate that capital will continue to flow back to the small cap sector as institutional investors find value in companies with strong growth and fundamental merit. During Q1-2024, our portfolio appreciated from the lows of Q4-2023, and we expect 2024 will be a more favourable year for small cap investing relative to 2023.

We are mindful of the divergence between the Canadian and US markets over the past decade, a trend which is likely to persist over the long term. Torrent plans to increase exposure to US-based growth equities over time, specifically in new economy sectors. We believe there are opportunities in US small to mid-cap equities that have potential to deliver attractive returns. Increasing our exposure to US growth equities will improve diversification within our portfolio while maintaining targeted upside potential.

Investing in the New Economy – sectors of interest

Artificial Intelligence

The rise of AI is a significant contributor to the market rally we are currently experiencing. While we are proceeding cautiously in this emerging sector, we firmly believe that most businesses will be impacted or disrupted by AI in one way or another in the coming years. Companies leveraging AI are poised to drive operational efficiencies and create new revenue streams, while disrupting traditional business models. The number of years forecasters estimated it would take to create an Artificial General Intelligence (AGI) system has decreased from 50 years in 2020, to just 8 years in 2023, a true testament to the pace of innovation in AI. [9]

Clean Energy and Technology

The market potential for cleantech companies is substantial and continues to grow as governments, businesses, and consumers increasingly prioritize sustainability and environmental stewardship. One of the most promising sectors within cleantech is renewable energy. With the declining costs of solar, wind, and other renewable sources coupled with advancements in energy storage technologies, renewable energy is becoming increasingly competitive with fossil fuels. Lower battery costs and increased performance are improving the economics of renewable energy and will continue to drive adoption in the foreseeable future. Torrent’s investments in this sector include Electrovaya and Argentia Capital Inc.

Medical Technology and BioTechnology

At the forefront of medical technology are advancements in cancer treatments, diagnostics, minimally invasive and robotic procedures, telemedicine, wearable devices, and digital health solutions. These technologies empower healthcare providers with tools to diagnose diseases earlier, treat patients more effectively, and deliver personalized care tailored to individual needs. One of Torrent’s holdings is Sona Nanotech Inc. (CSE: SONA), a company developing a therapy to eliminate certain cancerous tumours without the collateral damage of chemo, radiation, or surgery. Sona is a high-risk, speculative investment, yet with substantial upside if its progress remains positive.

Software as a Service (“SAAS”)

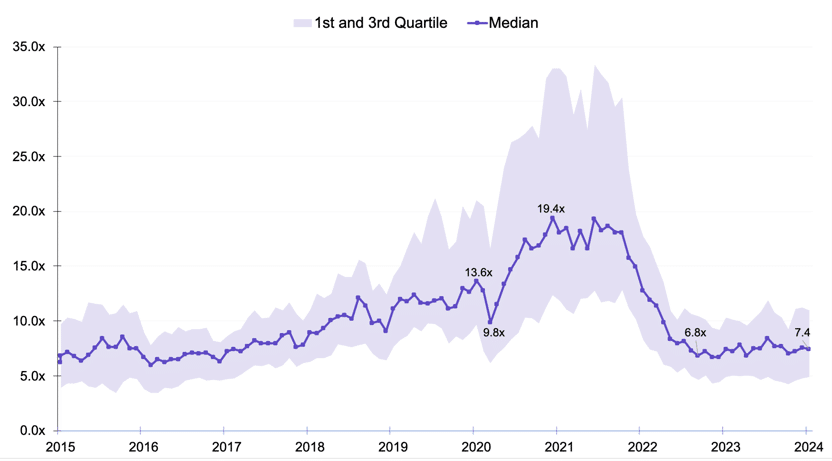

In Canada, SAAS company multiples have compressed considerably through 2022 and have yet to recover much ground. For example, SAAS EV/Revenue multiples reached 5-year lows of approximately 7x at the beginning of 2023. During the market excesses two years prior, this multiple exceeded 19x, with some companies experiencing even higher valuation levels.

Public Market SAAS EV/Revenue Multiple [10]

As valuation multiples remain compressed, Torrent views a potential opportunity. There are publicly traded SAAS companies with steady revenue and earnings growth yet share prices either pulled back or remained flat through the past year.

Our core holding Kneat provides an example: Despite ARR increasing 185% since the end of 2021, its share price remains below its close at the end of December 2021. Torrent is actively working to identify similar opportunities – companies that have delivered positive operating results and growth yet remain under appreciated by the market in our view. While its uncertain whether SAAS multiples will return to the highs of 2021, we can be more certain that the share prices of high-quality, high-growth SAAS companies will eventually re-rate to reflect their higher earnings and growth potential.

Final Thoughts

During 2024, we anticipate that Pattern Energy will make an investment decision on the first phase (300-megawatt) of their proposed wind energy to green hydrogen production project at the Port of Argentia. If the project is greenlighted, Torrent’s 50% interest in ACI is expected to generate positive cash flows to Torrent, thereby providing funding to re-invest in our actively managed portfolio.

Torrent’s diversified portfolio is well positioned in new economy technologies such as renewable energy, artificial intelligence, med-tech and SAAS, while maintaining exposure to the resource sector. We will adjust our portfolio as market developments occur, and we will continue to position our portfolio for growth in 2024 and beyond.

Torrent Capital

April 19th 2024

[1] “S&P/TSX Venture Metals & Mining (Industry) Index.” S&P Dow Jones Indices, www.spglobal.com/spdji/en/indices/equity/sp-tsx-venture-metals-mining-industry-index/#overview. Accessed 17 Apr. 2024.

[2] “S&P/TSX Venture Composite Index.” S&P Dow Jones Indices, www.spglobal.com/spdji/en/indices/equity/sp-tsx-venture-composite-index/#overview.

[3] “S&P/TSX Composite Index.” S&P Dow Jones Indices, www.spglobal.com/spdji/en/indices/equity/sp-tsx-composite-index/#overview.

[4] Marks, Howard. Easy Money. 9 Jan. 2024, www.oaktreecapital.com/insights/memo/easy-money.

[5] TMX Group. “~40% of the World’s Public Mining Companies Are Listed on TSXV and TSXV.” TMX Group, www.tsx.com/listings/listing-with-us/sector-and-product-profiles/mining.

[6] S&P Global| S&P Global. www.spglobal.com/en.

[7] “S&P/TSX Venture Metals and Mining (Industry) Index.” S&P Dow Jones Indices, www.spglobal.com/spdji/en/indices/equity/sp-tsx-venture-metals-mining-industry-index/#overview.

[8] “S&P/TSX Composite Energy (Sector) Index.” S&P Dow Jones Indices, www.spglobal.com/spdji/en/indices/equity/sp-tsx-composite-energy-sector-index/#overview.

[9] “Big Ideas 2023: Artificial Intelligence.” Ark Invest, ark-invest.com/big-ideas-2023/artificial-intelligence.

[10] Drazdou, Filip. “SaaS Valuation Multiples: 2015-2024.” Aventis Advisors, 10 Apr. 2024, aventis-advisors.com/saas-valuation-multiples.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This document includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Torrent disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. The reader is referred the Company’s annual financial reporting for a discussion of risks and uncertainties.