May 20, 2020 – Halifax, Canada – Torrent Capital Ltd. (TSXV: TORR) (the “Company”) is pleased to announce that it has granted 460,000 incentive stock options under the Company’s Stock Option Plan (“Option Plan”) to directors and officers.

Each option is exercisable into one common share at a price of $0.40 per share and will vest at the rate of 50% on each of the six and twelve month anniversary of the grant date. The options will expire five years from the date of grant. All other terms and conditions of the options are in accordance with the terms of the Company’s Option Plan.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This press release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Torrent disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contact:

Torrent Capital Ltd.

Rob Randall

Chief Financial Officer

(902) 442-7187

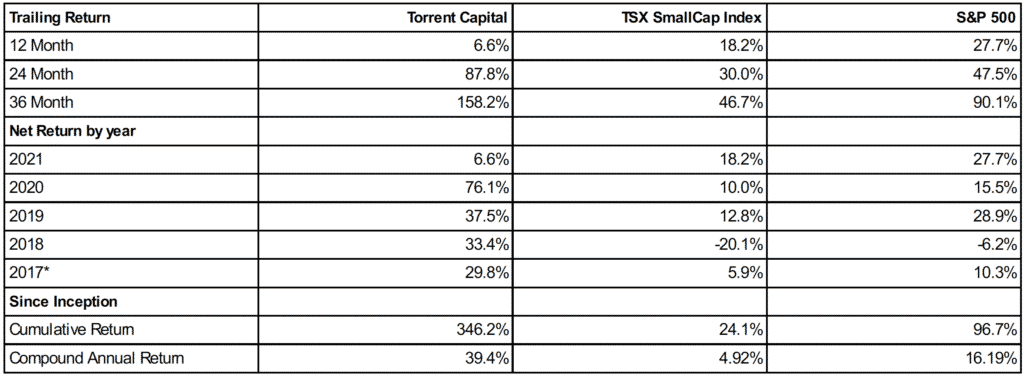

*6 month period from the date the Company was fully invested on June 30, 2017.

2021 year-end highlights include:

- NAV per share of 1.13, a 6.6% year over year increase from a NAV per share of 1.06 on December 31, 2020.

- Realized gain on investments of $3,475,437 for the year ended December 31, 2021 as compared to realized gains on investments of $7,244,237 for the year ended December 31, 2020.

- Unrealized loss on investments of $299,420 as compared to unrealized gains on investments of $7,312,662 for the year ended December 31, 2020.

- A cumulative return of 346.2% since the launching of Torrent as an Investment Issuer on June 30, 2017, representing a compound annual rate of return of 39.4%.

- Appointment of Mr. Wayne Myles and Mr. Carl Sheppard to the Company’s Board of Directors, effective November 30, 2021.

2021 was a year dominated by the reflation trade as the markets re-focussed on corporate fundamentals and value in light of cost pressures in the system. Commodity related investments performed well, with metals, mining, and energy among the top performers. The Torrent Portfolio returned 6.6% on the year, despite the pullback in some of the Company’s key portfolio sectors, including Technology, and Cleantech.

WildBrain Ltd. was a top performer in Torrent’s portfolio with a share price increase of 92.2% in 2021. Wildbrain has significantly improved its financial flexibility and cash generation, which is restoring confidence from the capital markets. This was further demonstrated by several analyst’s share price upgrades throughout the year. The company has seen growing revenues and earnings through 2021 combined with an improved balance sheet. Torrent remains confident that Wildbrain will continue its turnaround through 2022 as the company further monetizes its IP and delivers on its content strategy.

Kneat.com Inc. ended 2021 with a share price increase of 40.4% in 2021. Kneat graduated to the TSX during the year and continued to deliver rapid growth for its SAAS product. Annual recurring revenue for the year stood at $13.1M, an increase of 174% year over year. Kneat also closed a $22M bought deal financing in Q2 of 2021 putting it on strong financial footing as it continues to scale. Torrent is confident that Kneat is well positioned to deliver on its rapid organic growth plans throughout the coming year.

Clean technology stocks faced a significant pullback, declining by an average of 57.8% in 2021. Despite this sector-wide decline, Torrent’s Cleantech Investment Portfolio held up comparatively well with a loss of 9.4%. Although the sector faced multiple contraction on the back of considerable inflows of investment in 2020, the cleantech sector continues to show high growth potential as secular tailwinds spur innovation. Torrent’s cleantech portfolio consists of high-quality companies that have profitable growth potential in the longer term. Torrent has a long-term time horizon in this sector and remains bullish for the rest of 2022 and beyond for clean technology and ESG.

Torrent’s flexible mandate and ability to diversify allows the Company to reposition its portfolio to reflect the changing sentiment in the capital markets. Currently, Torrent is focussed on companies that are in a strong working capital position, have sound value propositions and are operating in segments of the market with deep secular trends.

“The markets for early-stage issuers remained challenging in 2021 due to a multitude of macro forces that increased market volatility, particularly towards the end of the year. Increasing interest rates and inflation create challenging markets for early-stage companies as future earnings get discounted at higher rates, weighing on valuations. That being said, Torrent is well positioned for the current environment, and we maintain a positive outlook on 2022 as we continue to cautiously navigate the markets from a growth perspective,” stated Wade Dawe, President and Chief Executive Officer of Torrent.

Torrent is a publicly traded Investment Issuer that invests in the securities of private and publicly traded companies. The Company invests in companies that are due to experience accelerated growth or are trading at a discount to their intrinsic value. Torrent offers investors the potential to earn above market returns while providing transparency, daily liquidity and a modest fee profile compared to competing investment products. Currently, the Company is actively researching investment opportunities in the clean technology sector.

For further information, please contact:

Scott Gardner

Chief Investment Officer

(647) 446-7474

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This press release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on forward-looking statements. Torrent disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. The reader is referred the Company’s annual financial reporting for a discussion of risks and uncertainties.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/120723