Key Points

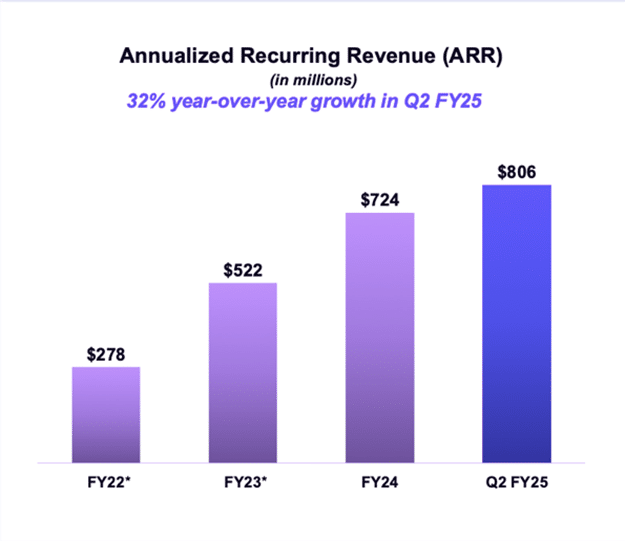

- Fastest growing cybersecurity software vendor among the top ten largest, growing ARR 32% YoY

- Strong industry tailwinds, including a rise in cyberattacks, growing ransomware threats, and the shift from legacy cybersecurity systems to AI-powered solutions.

- Recently announced a deal with Lenovo, in which SentinelOne’s software will be integrated into tens of millions of Lenovo PCs

- Trades at a discounted EV/Sales multiple of 10x, compared to the industry average of 15.19x

- Recently turned profitable and has $1.1B of cash and equivalents on the balance sheet with no debt

SentinelOne (NYSE: S) is a prominent leader in the modern cybersecurity landscape, leveraging advanced artificial intelligence to deliver best-in-class software solutions. Its flagship Singularity platform is trusted by some of the world’s largest enterprises, including Fortune 10, Fortune 100, and hundreds of Global 2000 organizations to prevent, detect, and respond to cyber threats. On November 27th 2024, SentinelOne closed at a share price of $28.08.

Technology

SentinelOne’s Singularity platform uses AI to automate cybersecurity processes that secure endpoints, cloud environments, and identities. It ensures comprehensive detection, prevention, and response to cyber threats. The platform automates key functions, drastically reducing the time to respond and recover from cyber attacks. In 2023 alone, SentinelOne disrupted over 1,000 human-operated ransomware intrusions, blocked 500,000 attacks, and identified more than 300 distinct malware families, showcasing its effectiveness against sophisticated threats.

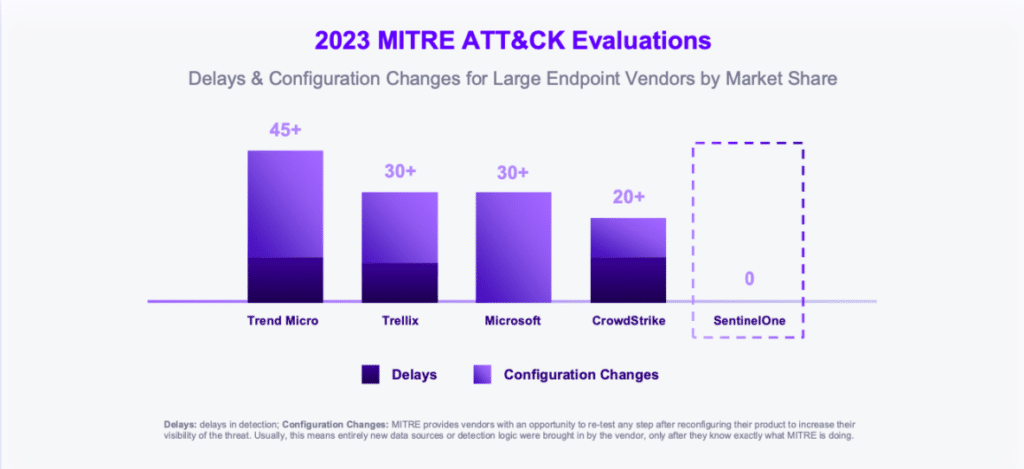

The Singularity platform delivers real-time insights and operational scaling without configuration delays. This is evidenced by its performance in MITRE evaluations, where SentinelOne scored 100% detection accuracy with zero re-configurations needed. In simpler terms, SentinelOne was the only platform to defend against these simulated attacks without requiring any intervention or modifications. This is significant because SentinelOne outperformed all its larger competitors in this evaluation, including CrowdStrike and Microsoft.

Market Position

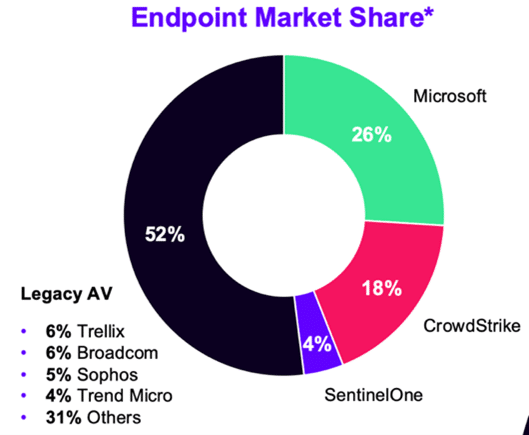

With a 4% market share in the endpoint cybersecurity market, SentinelOne is a small competitor compared to Microsoft, with a 26% share, and CrowdStrike at 18%. Although it is currently a small player in a large market, SentinelOne is still gaining market share. Note that 52% of the market still relies on legacy AV solutions such as Broadcom, Trellix, and Sophos, which lack the automation and AI-driven capabilities of modern platforms such as SentinelOne.

As corporations face more ransomware threats than ever, the demand for advanced cybersecurity solutions is growing. Gartner projects that by 2028, 30% of enterprises will consolidate endpoint security, detection, and identity threat management under a single vendor, up from just 5% in 2024. SentinelOne is well positioned for this market as organizations pivot from legacy systems to advanced AI-powered platforms. The company is known for its endpoint security products and is expanding into an enterprise-wide platform covering endpoint, cloud, data, and AI protection with the release of its new products.

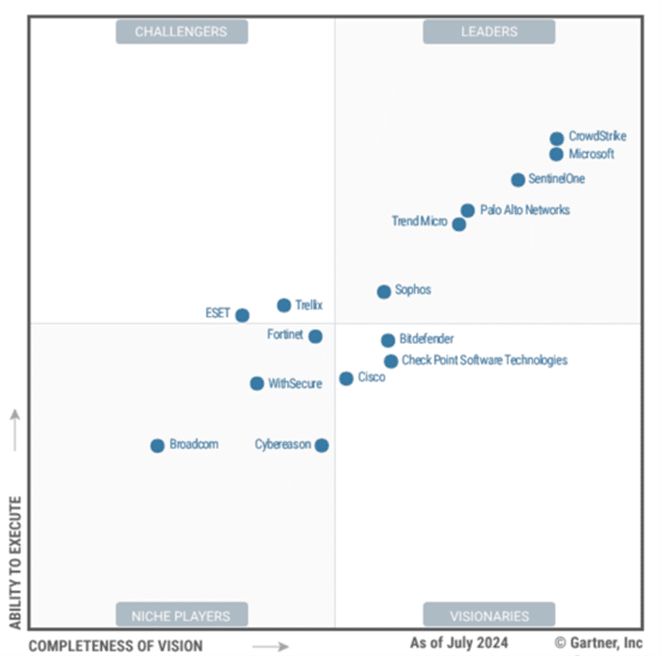

Despite its smaller size, the quality of SentinelOne’s product offerings solidify its reputation as a formidable competitor against larger players. There is plenty of independent evidence to suggest its offerings are among the best in the industry. For instance, Gartner recently named SentinelOne a global leader in endpoint protection for the fourth consecutive year, alongside Microsoft and CrowdStrike.

Growth Outpacing Peers

SentinelOne was recently ranked by Deloitte as the #1 fastest growing publicly traded security vendor. In Q2 2024, annual recurring revenue (ARR) grew 32% YoY to $806M, outpacing competitors such as CrowdStrike, Microsoft, and Palo Alto Networks. Growth from new product offerings such as purple AI, data lake, and cloud solutions is accelerating faster than endpoint, contributing over a third of Q2, 2025 bookings. International revenue is another growth area, with revenue from global markets increasing 36% year-over-year in Q2, 2025

Strategic Growth Plan

Strategic Partnerships

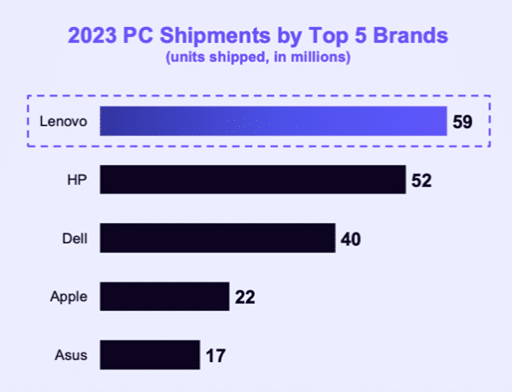

Partnerships with OEMs and tech providers are a crucial part of SentinelOne’s growth strategy. A notable example is its recent deal with Lenovo, where SentinelOne’s endpoint software will be integrated into millions of Lenovo PCs in the coming years. As the market leader in PC sales, Lenovo sold 59 million PCs in 2023. This contract win is highly significant and a strong validation of SentinelOne’s position as a market leader. Its notable that CrowdStrike has a similar agreement with Dell.

The insurance market is another growth avenue for SentinelOne. They have announced partnerships with several leading insurance companies and risk mitigation firms, in which insurers can offer the SentinelOne singularity platform at preferred rates to clients. By using the Singularity platform to improve cybersecurity protection, policy holders receive reduced insurance pricing. Sentinel works with leading firms such as AON, Employers Mutual, AXA XL, Coalition, Travelers, At-Bay, CFC, and Hanover.

Building an Enterprise-wide Platform

As SentinelOne expands its suite of product offerings, it appeals to a wider customer base and creates new revenue opportunities. The company got its foothold in the endpoint security market but has since expanded into a comprehensive enterprise security platform operating in domains such as cloud security, managed detection and response, data lakes, and identity. Over time, these new products are expected to become important revenue drivers.

Land and Expand

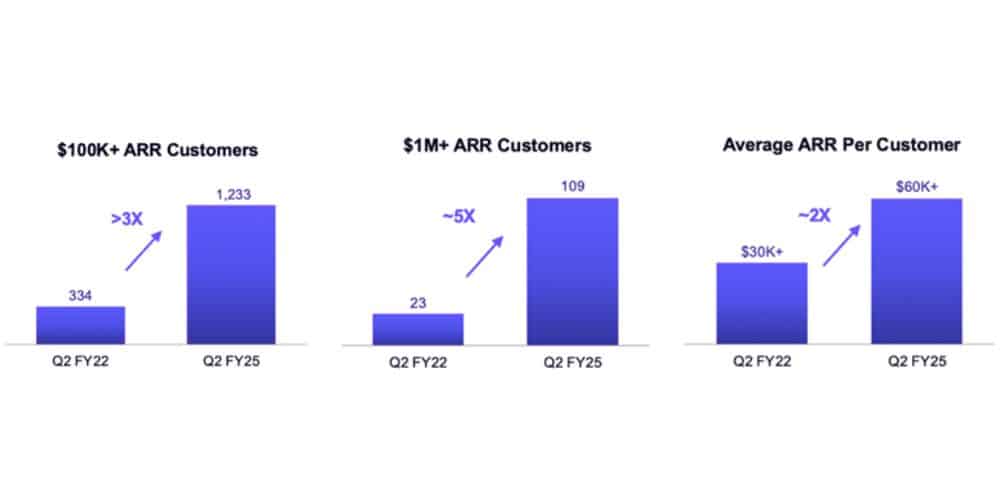

Since going public in 2021, SentinelOne’s land and expand strategy has been a success. During this period, the number of $100k ARR+ customers has tripled, the number of $1M+ ARR customers is up 5x, and the average ARR per customer has doubled. As SentinelOne continues to expand its suite of products and becomes an end-to-end cybersecurity platform, ARR per customer still has plenty of expansion potential.

Catalysts

Potential Takeover Candidate

Back in July 2024, reports surfaced that Google was eying an acquisition of cloud security software company Wiz for a reported $24B. Wiz reported ARR of $500M in August, up from $350M earlier this year. The implied acquisition price of Wiz represented a steep 48x ARR multiple. The deal did not close, and Wiz continues to grow independently, yet the contemplated ARR multiple exemplifies the premium valuations within the cybersecurity space. In March 2024, Cisco closed a $28B acquisition of Splunk Inc, further demonstrating that large established technology firms are looking to enter the cybersecurity market. Splunk is an AI-driven data analytics and visualization company that is widely used for cybersecurity applications. SentinelOne presents a compelling case as a cybersecurity target.

Rise of Ransomware and Cyberattacks

A quick web search of the terms “cyber attack” or “ransomware” on any given day will return headlines of major companies and governments falling victim to hackers. The trend continues to accelerate and SentinelOne is well positioned with its leading AI powered solutions.

CrowdStrike Outage

In July 2024, CrowdStrike experienced a software malfunction which caused widespread disruptions affecting businesses and governments globally. Approximately 8.5 million systems failed and went offline from airports and hospitals to stores and emergency services. Noted as potentially the largest outage in IT history, it underscored vulnerabilities in competitor CrowdStrike’s systems. During its Q2, 2025 earnings call, SentinelOne’s management addressed the significant impact of CrowdStrike’s outage on the industry.

During the earnings call, analysts raised questions about how this incident might impact SentinelOne’s sales pipeline and growth trajectory. Management remained conservative, highlighting the lengthy sales cycles typical for acquiring new customers, thus avoiding overpromising any immediate benefits. However, SentinelOne’s CEO explicitly stated in the shareholder letter: “As a result [of the CrowdStrike Outage], customer interest in our platform and AI-based security has distinctly risen.” This suggests that CrowdStrike’s outage could present a tailwind for SentinelOne, potentially boosting sales momentum and bookings in the coming quarters. Additionally, the long-term reputational and brand damage that CrowdStrike suffered could work in favour of SentinelOne. The upcoming quarterly results for Q3 will be the first earnings period that may show impacts of the outage. Analysts will be closely watching for any signs of growth in the sales pipeline and updated revenue guidance.

Financials and Valuation

SentinelOne went public on the NYSE in June 2021 at an IPO price of $35 per share. During the post-COVID market rally, it’s stock price surged to over $75, driven by lofty valuations that ultimately proved to be unsustainable. Over the next two years, the share price experienced significant declines as expectations adjusted and valuation multiples normalized in tandem with the broader software market. In early 2024, a slight reduction in full-year revenue guidance—from a midpoint of $815 million to $811.5 million—further weighed on sentiment, triggering a 40% sell-off over the subsequent weeks.

5 Year Price Chart

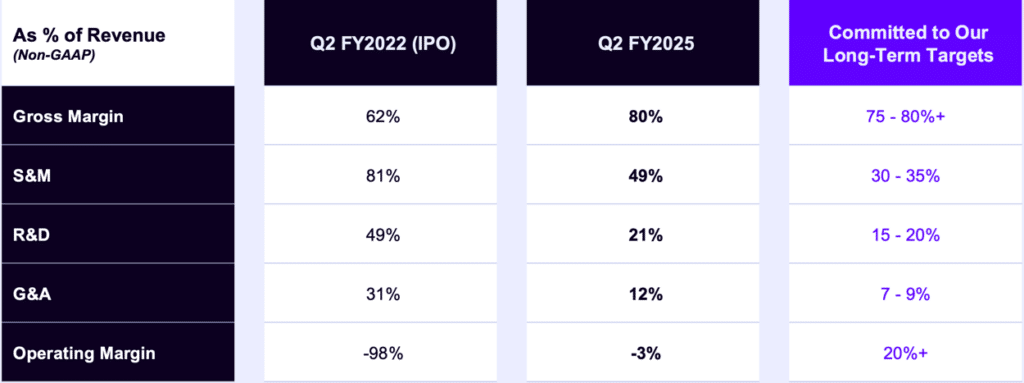

The company has grown and transformed into a stronger and more efficient business since going public in 2021. Annual revenues have increased over sixfold, while the company has transitioned from burning substantial amounts of cash to achieving positive non-GAAP net income and operating cash flow in the most recently reported quarter. Gross margins also improved, rising from 62% at the time of the IPO to 75% in Q2 2025. The balance sheet is rock solid with $1.1B of cash and equivalents and negligible debt.

SentinelOne has proven that its business is highly scalable. Operating expenses as a percentage of revenue halved while topline growth remained strong, displaying a high degree of operating leverage. Management’s long-term operating margin target of 20%+ underscores the substantial profitability potential on the horizon.

Despite such progress, SentinelOne’s stock currently remains below its IPO price, more than three years later. While ARR growth has moderated from the explosive 127% year-over-year pace seen in 2021, the company has matured into a larger and more profitable enterprise. With ARR still expanding at an impressive 32% year-over-year, it remains the fastest-growing cybersecurity software company among the top ten largest.

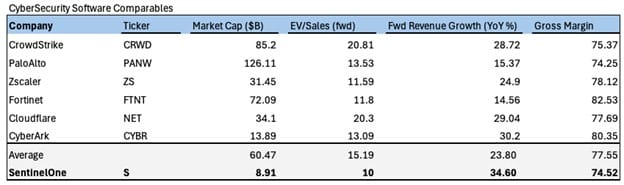

Comparable Company Analysis

Leading cybersecurity software companies are prioritizing growth and aggressively investing in their businesses rather than optimizing profitability. EV/Sales is an appropriate valuation metric for comparison purposes, as earnings are often suppressed by design. Despite outpacing its peers in growth, SentinelOne trades at a discounted sales multiple of 10x compared to the peer average of 15.19x. With forward revenue growth projected at 34.6%, well above the peer average of 23.8%, and gross margins in line with competitors at 75-80%, the valuation gap appears unwarranted.

Risks

Competition

The cybersecurity industry is intensely competitive, with dominant players such as CrowdStrike, Microsoft, and Palo Alto Networks exerting significant competitive pressure that could impact SentinelOne. Given the growth trends and the market size, competition is to be expected. However, there is room for several players, and especially for new innovative offerings as older legacy software systems are being replaced with modern AI driven solutions such as SentinelOne’s.

Software Risks

As we saw with the CrowdStrike incident back in July, an outage or any form of security breach can be damaging to the company and brand. Thus far, SentinelOne has an impeccable record of defending against ransomware and hacker attempts and has avoided such risks.

Evolving Technology

Rapid technological advancements present both opportunities and challenges. Innovations in AI and increasing competition could shift demand if competitors are perceived to offer superior solutions. The company must also continually adapt to evolving threats as hackers and ransomware attacks grow more sophisticated. SentinelOne currently leads in leveraging AI for endpoint and cybersecurity, positioning itself favourably against rivals.

Quarter to Quarter Volatility

SentinelOne’s share price tends to fluctuate following quarterly results. Any delayed contracts or slightly lower guidance could prompt short-term market overreactions, as occurred early in 2024. The focus should remain on the company’s sustained growth trajectory rather than short-term earnings volatility.

Conclusion

SentinelOne has often been overlooked by investors and institutions, due to its smaller size, past operating losses and inflated valuation. Since listing publicly in 2021, the company has demonstrated substantial progress. It achieved profitability and maintains industry-leading growth, yet trades at valuation multiples that remain discounted relative to peers. Wall Street sentiment appears to be shifting, with several analysts raising price targets following SentinelOne’s annual cybersecurity conference, OneCon, recently held in October.

News releases further highlight the company’s momentum. SentinelOne has announced key partnerships with Lenovo, AWS, and Google Cloud, strengthening its strategic position and market reach. The CrowdStrike outage earlier this year has the potential to drive increased demand for its solutions. With these factors in play, I suspect there is potential for upward guidance revisions in the upcoming Q3 earnings report to be released on December 4th, which could lead to a re-rating of the stock. While short-term market reactions can be unpredictable and uncertain, SentinelOne stands out as a strong long-term investment opportunity in the cybersecurity space offering a compelling combination of growth, profitability, and attractive risk-reward characteristics.

*all amounts in USD unless otherwise specified.

Disclaimer

The content provided is for informational purposes only and represents the personal opinions of the author. It should not be interpreted as financial, investment, or trading advice. The stock picks, analysis, and commentary are based on the author’s own research, views, and experience in the market, and are not recommendations to buy, sell, or hold any particular securities.

All information presented here reflects the subjective opinion of the author and may not align with other sources or perspectives. Investing in stocks involves risk, and it is essential to perform your own independent research or consult a licensed financial advisor before making any investment decisions.

The author may hold positions in the securities discussed but will disclose any such holdings in accordance with regulatory requirements. Market conditions can change rapidly, and the information provided may not always reflect the latest market developments. Past performance of stocks mentioned is not indicative of future results.

Forward-Looking Statements

Certain information in this article may contain forward-looking statements, including but not limited to projections, forecasts, and expectations regarding future performance of securities or markets. These statements are based on the author’s current beliefs, assumptions, and available information. Forward-looking statements are inherently uncertain and involve risks and uncertainties that could cause actual results to differ materially from those anticipated. The author is under no obligation to update any forward-looking statements.

By reading this article, you acknowledge that reliance on any information provided is at your own risk, and the author is not responsible for any losses or damages resulting from your investment choices.

Torrent Capital and the Author are long shares of S.