Author: Evan Dawe

MDA Space (TSX: MDA) is a Canadian based developer of space technologies for government and commercial use. MDA manufactures and sells space robotics, satellite systems, and earth observation imagery and analytics. MDA is an established market leader in the space economy, which is expected to grow to a US $1.8 Trillion market in the next decade[1]. The stock recently closed at a price of $16.49 per share on September 18th, 2024.

MDA’s Lines of Business

Satellite Systems (44% of Revenue)

As a prime contractor and supplier of satellite systems and subsystems, MDA serves commercial and government mission partners worldwide. Manufactured in Quebec, these satellites span a growing number of use cases including space-based broadband internet, Direct-to-Device satellite communication, and IoT connectivity.

Robotics (32% of revenue)

MDA provides autonomous robotics and sensors used to operate in space and on the surfaces of the Moon and Mars. MDA is the world leader in space-based robotics including over 100 space shuttle missions, assembly of the International Space Station (“ISS”), life-cycle operation of the ISS, and rover technology on Mars. The world’s first commercial space stations are being introduced by companies such as Axiom space, which will be built and serviced using MDA’s CANADARM3 technology.

GeoIntelligence (24% of Revenue)

The company is an owner, operator, and prime contractor for both Earth observation and space observation missions. MDA uses satellite-generated imagery and data to deliver critical and value-added insights for a wide range of end uses, including in the areas of national security, climate change monitoring and maritime surveillance.

3-Year Chart

Exceeding Expectations

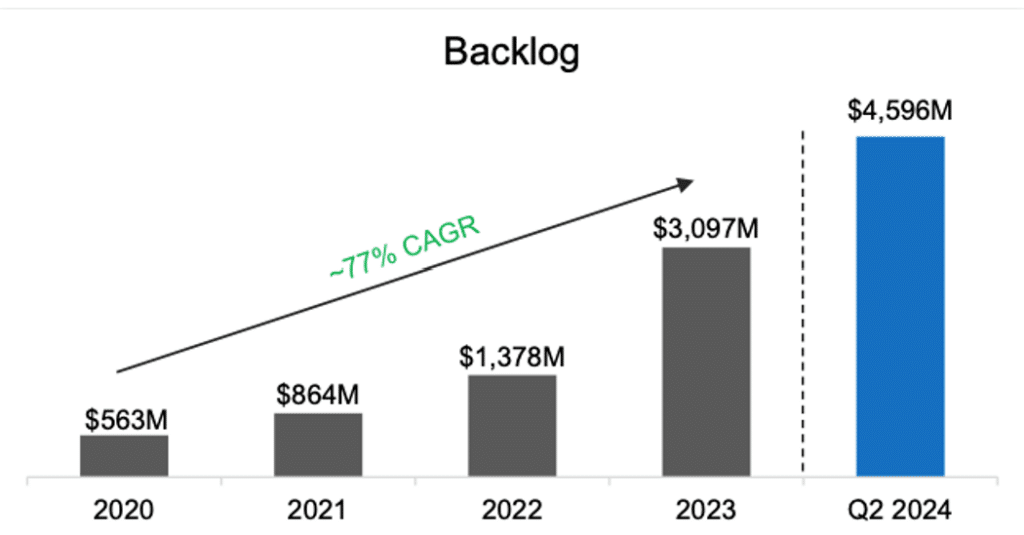

Q2 Performance was strong, surpassing analyst expectations across the board. Both revenue and EBITDA exceeded estimates, prompting an upward revision of full-year 2024 revenue guidance. The company is experiencing accelerated top-line growth, with Q2 revenue up 23% year-over-year compared to Q2 2023. Adjusted EBITDA grew 21%, while the sales backlog surged to $4.6 billion, a remarkable 318% increase over the same period last year.

Management’s guidance has proven conservative in the past few quarters. In Q2, revenue guidance was raised, and EBITDA guidance was tightened toward the upper end of the provided range. Most notably, the company now expects to be free cash flow positive in 2024, one year earlier than previous guidance suggested. This is significant as it allows MDA to begin de-leveraging its balance sheet and paying down debt much sooner than previously anticipated. During the recent earnings call, management emphasized that the debt-to-EBITDA ratio likely peaked in Q1 at 2.6x and is now declining to below 2x. With large contracts set to ramp up in Q3 and Q4, combined with a strong $17B+ sales pipeline, management’s updated guidance appears to be noticeably conservative.

Despite the 318% YoY increase in backlog to $4.6B in Q2, MDA’s robust sales pipeline is expected to drive further growth. On the Q2 earnings call, management guided that they are targeting a backlog of over $5B by year-end. This growth is anticipated to more than offset the removal of several large contracts as they are fulfilled over time.

Considerable Upside from Existing Contracts:

- MDA has a 327M USD contract with GlobalStar, a provider of mobile satellite services, to design, manufacture, and sell 17 satellites for use by their primary customer, Apple Inc. Apple uses MDA’s satellites to enable certain direct to device services such as the new ‘SOS’ feature on iPhone. The direct to device market is in its infancy, and Apple may be just scratching the surface of what is to come as competition heats up in the direct to device market. This contract with Apple has potential to expand into a multi-billion-dollar deal with hundreds, if not thousands of satellites required in the coming years.

- Back in August 2023, MDA announced a $2.1B contract with Telesat to supply satellites for its LightSpeed constellation. This contact includes 198 satellites, with an option to add an additional 100 satellites. This contract has significant expansion potential and is expected to provide revenue from maintenance and replacement for years to come. The LightSpeed constellation will expand the reach of affordable high-speed internet and 5G networks across Canada and the internationally.

- MDA has an unnamed customer that recently expanded its contract from $180M to $300M and is anticipated to grow to a $750M order for 36 NGSO satellites by end of year 2024.

- In July 2024 MDA announced another $1B contract from the Canadian Space Agency to design and deliver the CANADARM3, a space robotics system used to build and service space stations. This contract is expected to run until 2030.

- In April, MDA Space announced a new product line of space Robotics called MDA SKYMAKER. SKYMAKER is designed to support a diverse range of missions, including lunar surface rovers and landers, space stations, satellite servicing in all orbits, and in-space assembly and manufacturing. Significant upside is present as orders for this new product line commence.

Priced for Value, Positioned for Growth

Most analysts appear to view MDA through the lens of traditional value metrics, focussing on discounting near term cash flows (which have historically been negative) and thus assigning low implied EBITDA multiples to the stock. Although MDA is now expecting to be free cash flow positive in 2024 for the first time since going public, this approach is still missing the big picture. Overlooked is the significant long term growth opportunity that is forthcoming. Demand is rapidly building for MDA’s products, and they are investing aggressively to increase manufacturing capacity, while also releasing new product lines. Despite being a 55-year-old company, MDA is still in growth mode, yet it trades at value stock multiples.

Expanding Manufacturing Capacity to Meet Demand

As a testament to the strong demand for MDA’s products, most notably in the satellite sector, MDA is doubling its satellite manufacturing capacity. Construction has begun at its new facility in Quebec, which is expected to deliver up to two MDA Aurora digital satellites a day, making it the largest high-volume manufacturing facility in its satellite class. CAPEX spend has been high but will likely moderate after 2025 when the new facilities and product lines are completed.

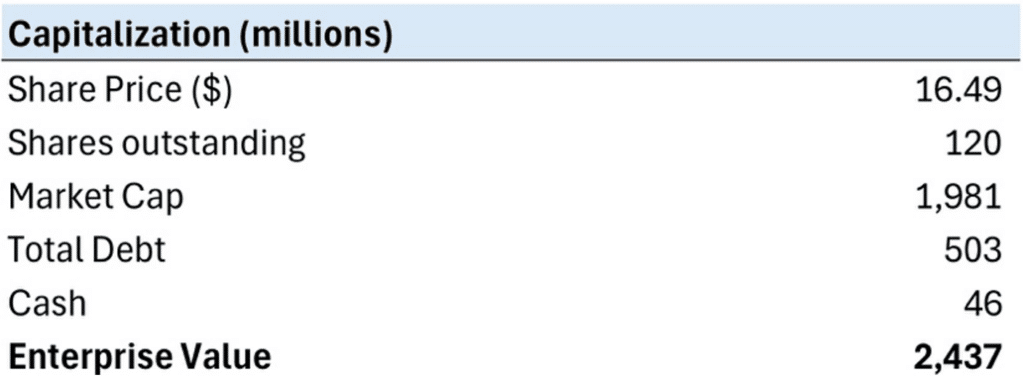

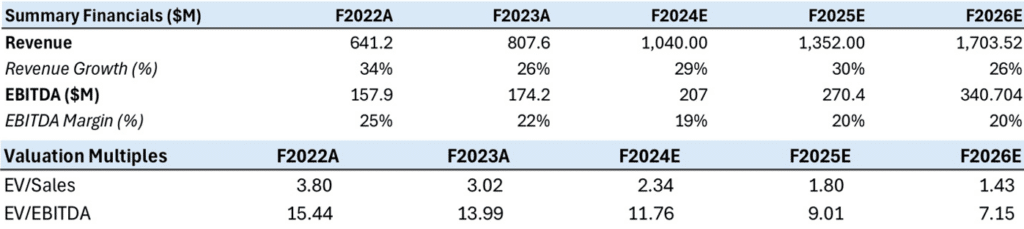

With a market cap of 1.98B, debt of 503M, cash of 46M, MDA’s enterprise value is currently about $2.4B.

Based on the midpoint of MDA’s 2024 revenue guidance of $1,040 million, and taking the adjusted EBITDA guidance of 200M – 210M for 2024 while maintaining a target 19% to 20% EBITDA margin, MDA’s EV/EBITDA multiple is 11.8x for 2024 and declines to 9x in 2025 and 7x by 2026. These estimates use conservative assumptions based on company guidance of 30% topline growth in 2025, flat margins, and 26% growth in 2026.

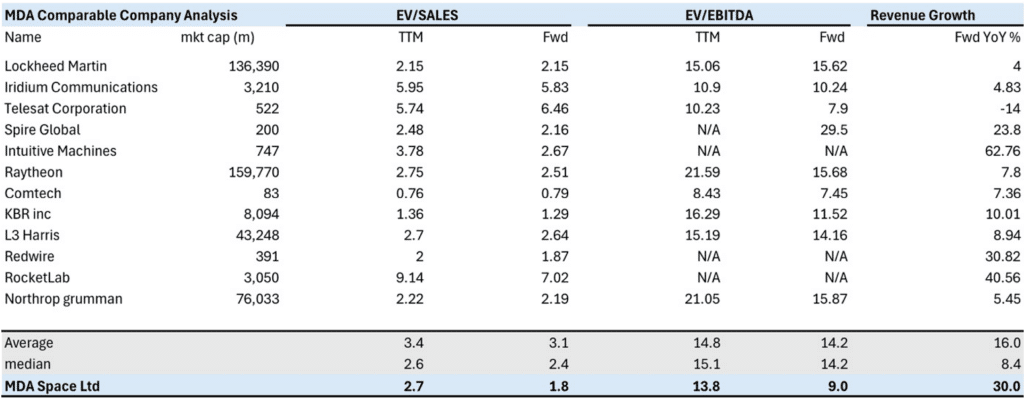

In comparison to the peer average EV/EBITDA multiple of 14.8x, MDA is trading at a discounted price of 7x F2026 EV/EBITDA, while its revenue is expected to grow at a higher rate than its peer group.

Sustainable Growth Provided by Long Term Contracts

A common concern when investing in a business that relies heavily on manufacturing and one-time sales is that revenue may be lumpy, leading to unsustainable growth. This does not appear to be the case for MDA as the large and growing backlog will support revenue and growth visibility for the next several years. Announced long term contracts include:

- $1B Canadarm3 contract that runs until 2030

- The multi-billion-dollar Telesat contract is expected to run through 2027, with service, maintenance, and add-ons extending longer

- The $250M contract extension to support robotics operation on the International Space Station will run from 2025 to 2030

- MDA is responsible for the design and integration of an electronic warfare system for the Royal Canadian Navy, in a contract with $1.5B revenue potential between 2020 and 2040

Commercial Interest in the Space Industry Has Taken Off

Launch Costs are Rapidly Decreasing

Over the past decade, innovation in launch technology, particularly the development of reusable rockets, has driven down space launch costs by at least a factor of ten[1]. The cost per kilogram for launches is expected to continue to decline and may create a trend similar to Moore’s Law. This reduction in costs is making space operations economically viable, opening the door for greater private sector participation in the industry.

Space is Becoming a Key Pillar of National Security

Space has emerged as a critical military domain, complementing the traditional arenas of air, land, and sea. In response, nations worldwide are ramping up military spending on space-based initiatives, ushering in a new era of the space race. MDA is a direct beneficiary of increased defense spending as a trusted partner of the Royal Canadian Navy and through its work with defence giants such as Lockheed Martin.

Direct-to-Device Global Connectivity

SpaceX, Amazon, Apple, and Google, among others are expected to deploy tens of thousands of satellites for their constellations this decade[3]. Direct to device internet is likely the future of telecom, enabling global internet connectivity, IoT, and 5G communications around the world.

Space Exploration

In the aftermath of the tragic “Challenger” mission in 1986 when seven astronauts were killed on live television in a failed rocket launch, public support of space exploration waned for a couple of decades. In recent years, technological developments have improved safety and reduced launch costs sparking a renewed interest in space exploration and the desire to explore other planets. EuroConsult estimates that there will be over 750 space exploration missions over the next decade, which is a substantial increase from the 236 missions over the last ten years[4].

Risks

Potential for Contract Delays or Loss

Several large contracts make up a significant portion of revenue, any potential delays or losses of these contracts could have a material impact on the business and stock price.

Evolving Technology and Disruption

MDA operates in an industry facing rapid technological change. Market demands could change as a result of technological developments that could make certain products obsolete.

Contract Execution Risk

With several large contracts, MDA is under pressure to ramp up production. Any manufacturing issues or product quality defects could negatively impact performance.

The Race to Innovate

The Space industry is dominated by a handful of large dominant players. It is crucial for MDA to continuously invest in R&D to remain ahead, at the risk of losing deals to competitors

Conclusion

MDA has established itself as a leader in space robotics, satellites, and geo-intelligence. Despite growing revenue at almost double the industry average, the company trades at a significant discount to its peers. MDA is well positioned to benefit as investment in the space industry expands over the next decade. The company’s existing contracts, including its arrangement to supply satellites to Apple, present considerable upside potential that does not appear to be priced into the stock. Additionally, as space operations become increasingly viable for commercial and private businesses, I expect MDA will secure new orders in the coming quarters while further expanding its backlog.

As announced in August during Q2 2024, MDA became free cash flow positive and is actively optimizing its leverage ratios, reducing risk, and improving profitability. Despite the positive progress, the stock is trading near its IPO price from three years ago. The current valuation does not reflect the growing backlog and profitable growth opportunities on the horizon. Given the undervalued share price, high growth, and long-term contracts with top tier clients, Torrent believes the upside potential far outweighs the risks. MDA is well positioned for significant share price appreciation over the next two to three years, further solidifying itself as a true Canadian success story.

*all amounts in CAD unless otherwise specified.

[1] Alizée Acket-Goemaere, Ryan Brukardt, Jesse Klempner, Andrew Sierra, and Brooke Stokes. “Space: The $1.8 Trillion Opportunity for Global Economic Growth.” McKinsey & Company, April 8, 2024.

[2] Jones, Harry W. “The Recent Large Reduction in Space Launch Cost.” The Recent Large Reduction in Space Launch Cost, July 8, 2018.

[3] Jarvis, David, Duncan Stewart, Raghavan Alevoor, and Kevin Westcott. “Signals from Space: Direct-to-Device Satellite Phone Connectivity Boosts Coverage.” Deloitte Insights, November 30, 2023.

[4] Sadek, Saly. “Lunar Ambitions Boost Space Exploration Funding as Investment Set to Reach $33 Billion by 2032.” Euroconsult Group, merged with SpaceTec Partners to form Novaspace, September 29, 2023.

Disclaimer

The content provided is for informational and educational purposes only and represents the personal opinions of the author. It should not be interpreted as financial, investment, or trading advice. The stock picks, analysis, and commentary are based on the author’s own research, views, and experience in the market, and are not recommendations to buy, sell, or hold any particular securities.

All information presented here reflects the subjective opinion of the author and may not align with other sources or perspectives. Investing in stocks involves risk, and it is essential to perform your own independent research or consult a licensed financial advisor before making any investment decisions.

The author may hold positions in the securities discussed but will disclose any such holdings in accordance with regulatory requirements. Market conditions can change rapidly, and the information provided may not always reflect the latest market developments. Past performance of stocks mentioned is not indicative of future results.

Forward-Looking Statements

Certain information in this article may contain forward-looking statements, including but not limited to projections, forecasts, and expectations regarding future performance of securities or markets. These statements are based on the author’s current beliefs, assumptions, and available information. Forward-looking statements are inherently uncertain and involve risks and uncertainties that could cause actual results to differ materially from those anticipated. The author is under no obligation to update any forward-looking statements.

By reading this article, you acknowledge that reliance on any information provided is at your own risk, and the author is not responsible for any losses or damages resulting from your investment choices.

Torrent Capital and the Author are long shares of MDA.