Author: Evan Dawe

Summary

- Lemonade is an insurtech company automating policies and claims with AI, enabling advantages in scalability and efficiency.

- Loss ratios have improved materially, now more in line with industry averages, marking a key inflection point in underwriting performance.

- In Force Premiums are growing at 21% CAGR, while non-growth OpEx remains flat, highlighting strong operating leverage.

- A young customer base and efficient operations create a growth flywheel that improves risk modeling, lowers costs, and accelerates growth.

- At a $2.5B EV and 36% forward growth, LMND is a misunderstood early-stage tech disruptor in a $2T+ insurance market.

Henrik Sorensen/DigitalVision via Getty Images

The top ten largest insurance companies in the USA were all founded nearly a century ago. Insurance is one of the oldest and largest industries, with trillions of dollars in annual premiums written in the USA alone, yet it is also one of the least digitally transformed industries. This presents an opportunity.

According to a McKinsey report on the insurance industry:

Insurers that seize the opportunity to deeply integrate AI into everything they do will be poised to come out on top. They will be able to conduct more business, faster, in a more personalized manner, and with a better understanding of the underlying risk. Insurers that merely dabble in AI risk being left in the dust, unable to keep up with their AI-native peers.”

This is exactly the approach that Lemonade, Inc. (NYSE:LMND) is taking-building a technology-native insurance company that is as automated as possible using AI. LMND is not just another company hopping on the AI hype bandwagon; in 2015 it started building its own insurance-focused AI models and agents that are core to virtually all aspects of the business. In fact, 97% of its policies are sold through automated bots, and 55% of its claims are fully automated, a growing percentage of total claims.

Improved AI Models: An Inflection Point

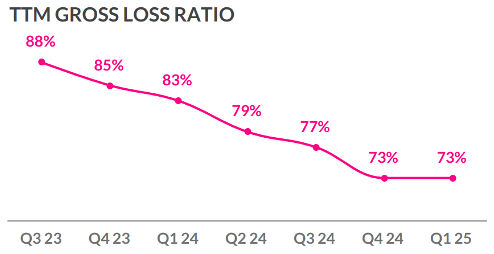

When I first reviewed LMND in early 2024, I initially couldn’t get past the weak loss ratios and steep losses on the income statement. However, since then, management has demonstrated the scalability of the business model by delivering strong, consistent growth in In Force Premium while improving loss ratios for several quarters in a row. LMND appears to be reaching an inflection point, where its loss ratios are now competitive with traditional insurers despite lower customer prices. As the models improve, LMND should be able to demonstrate performance advantages over traditional models, allowing them to continue to price below the market to maintain strong growth.

Gross Loss Ratio (TTM) (Lemonade Investor Relations)

*Note that Q1 2025 was impacted by the California wildfires. Excluding the impact of the wildfires, the gross loss ratio was 59%.

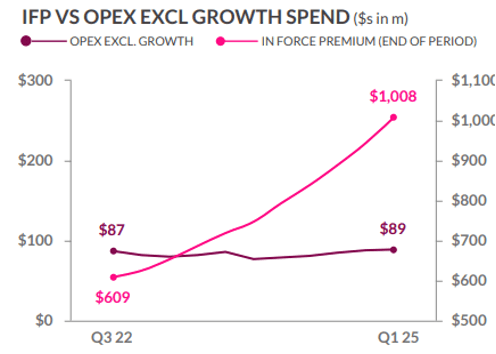

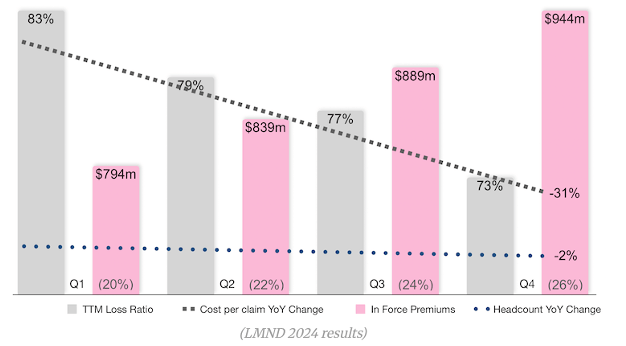

The AI models are rapidly improving, and it’s starting to become clear that LMND is capable of scaling without increasing its non-growth-related operating expenses. In Force Premiums have grown at a 21% CAGR, while operating expenses (ex growth spend) grew at only a 1% CAGR, demonstrating the powerful operating leverage in this business model.

IFP Growth vs OpEx (Lemonade Investor Relations)

While typical insurance companies need to hire new employees to scale linearly, LMND has grown premiums, customer count, and revenue while employee headcount remained virtually flat. This is because LMND’s sales and claims are mostly automated. The improvement in loss ratios was achieved with the same number of employees and increased scale. The company’s AI models are improving quickly and are becoming competitive with traditional models, but with the capability of scaling much faster and cheaper.

Declining Loss Ratio, Flat Headcount, Growing IFP (LMND 2024 Investor Day)

Management

I have a strong preference for founder-led businesses, especially when the founders have completed previous exits. LMND founder Shai Wininger is just that. As a co-founder of Fiverr (FVRR), LMND is the second billion-dollar company he founded. His co-founder, Daniel Schreiber, is an attorney by training and was previously president of Powermat.

Danial and Shai sought to create a new insurance model that shakes the typical negative reputation typically held by traditional insurers, operates more efficiently, and materially reduces costs for customers.

Business Model and Brand

Traditional insurers are incentivized to deny claims, which directly improves their profitability. This creates conflict with customers and leads to poor brand reputations in the industry. LMND has a different model; it collects a flat percentage fee from each premium written and leaves the remainder leftover to fund claims and reinsurance. Unlike legacy insurers, any leftover premium unused for claims or reinsurance gets donated to charities of the customers choosing through LMND’s giveback program. The excess premiums donated to charity have been under 0.5% of gross earned premiums historically, thus are not an overly significant amount to the point where it would negatively affect shareholders. For reference, $2M was donated in 2024.

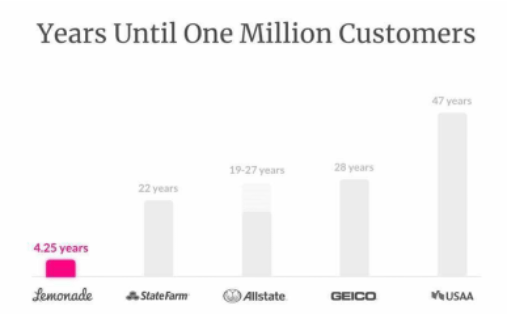

While the effectiveness of the giveback program strategy is debated among analysts, I view it as a creative marketing and brand perception tactic, and it appears to be working. 70% of LMND customers are under 35 years old. For reference, Uber, Airbnb, Shopify, and Google all had similar customer demographics when they were at a comparable stage. Customer reviews have been strong-it has a 4.9/5 on the app store with 83k ratings. LMND is also the #1 insurer in market share of first-time renters under the age of 35. The growth has been impressive; LMND reached 1 million paying customers faster than the major insurance companies and most tech companies.

Years to reach 1m customers (2024 Investor Day)

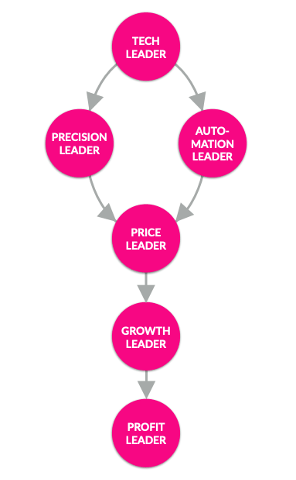

The Growth Flywheel

Unlike traditional insurance models, LMND’s AI native strategy creates a strong flywheel effect. As the company achieves greater scale, its data and AI models improve. More data and better AI improve risk models and calculations, which leads to lower costs and customer prices. Low prices allow the company to undercut competitors while maintaining competitive loss ratios, which leads to faster growth. Growth leads to scale and closes the loop. High-growth rates can be expected to be sustained well into the future, and profitability will improve as a result.

Lemonade Growth Strategy (2024 Investor Day)

Opportunities for Growth

Cross-selling Existing Customers

Only 5% of customers have multiple policies with LMND. This figure is low and suggests there is significant room for expansion from cross-selling existing customers alone, in addition to signing new ones. For example, there are 2.5 million non-car customers that can be cross-sold the new car insurance product.

On the Q1 earnings call, the CEO stated that:

We’ll continue to add a significant number of customers; more than a majority of that growth will come from adding customers, but that the ability to grow over time from our existing customers will continue to increase over time.”

Geographic Expansion

With its recent state launch in Colorado, Lemonade car insurance now has coverage of 40% of the US auto insurance market, and market share remains well below 1%. There is significant room for expansion in the US alone across all of its products. Lemonade also launched in Europe in France, Germany, the Netherlands, and the UK, and plans to launch in a list of 25+ other European countries soon, according to the website. LMND has a waitlist with over 700k potential customers on it in regions where it does not currently operate. Considering the enormous scale of the global insurance market, it becomes clear that LMND is still an early-stage company with lots of growth potential.

Misunderstood by Analysts

Lemonade is often misunderstood by investors and analysts. Most of the coverage is currently from insurance sector-specific analysts. They often point out the company’s historical losses, unprofitability, and multiples that are higher than insurance sector averages in their mostly bearish reports. What they are missing is that this company should be assessed more as an early-stage tech company instead of being directly compared to mature insurance giants like Progressive or Geico. It is currently still in growth mode and spending too aggressively to gain market share, like an early-stage tech company would. Looking at valuation multiples, LMND’s forward EV/Sales multiple of 3.5x and Price/Book of 5x may appear high compared to traditional insurance competitors, but they are reasonable for a tech company with a 36% forward growth rate and a path to profitability in 2026/2027.

Growth-related SG&A expenses have been the primary reason for Lemonade’s significant bottom line losses. For a growing tech company in an early stage of its lifecycle, high growth spend is normal. It takes time and intense amounts of growth spend to capture sufficient market share to disrupt legacy players in the industry. It took Amazon 7 years, Netflix 6 years, Airbnb 9 years, and Uber 14 years to become profitable. Since 2023, management has consistently reiterated that it will become EBITDA positive in 2026 and net profitable in 2027. Management has a strong track record of exceeding guidance and estimates and has beat revenue and EPS estimates in each of the last 10 quarters, leaving me with no reason to doubt these estimates.

As the company achieves scale, the SG&A expense lines should decline as a percentage of revenue, becoming less burdensome over time. In the long run, loss ratios, expense ratios, and growth rates are the more important metrics to track closely, all of which are trending in the right direction and have potential to surpass that of traditional insurers.

Risks

Investing in Lemonade is a bet that AI will reach a stage where it can outperform traditional insurance models and humans. Obviously, this is no small feat, and the stock is high-risk as a result. LMND will only succeed if it maintains high growth rates well into the future and can sustain profitability and capture meaningful market share from existing firms. In the meantime, the Company has $1B of cash and investments on its balance sheet, which provides a strong buffer until profitability is reached. Prior to the California wildfires in Q1, Lemonade was cash flow positive.

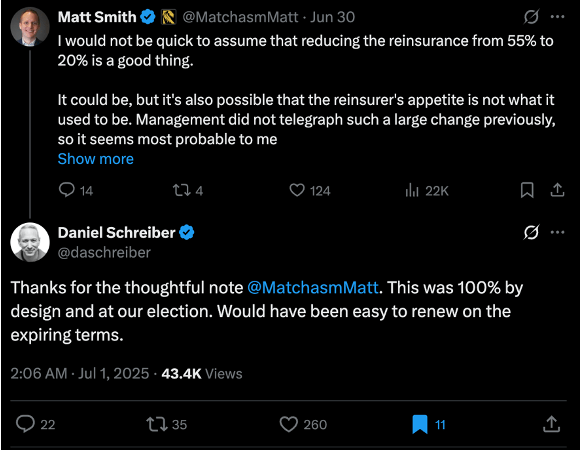

Catastrophes and natural disasters are the obvious risks in the insurance sector that can impact results. Lemonade also recently reduced the percentage of its book ceded to reinsurance from 55% to 20%. I have mixed opinions on this. It will increase revenue and profitability but comes with higher risk in the event of an insurance catastrophe like the California wildfires. That being said, it does show management’s confidence in the quality of their risk models and willingness to scale aggressively. To address speculation from analysts about re-insurers choosing to drop Lemonade, LMND co-founder Daniel Schreiber stated on X that it was their decision to drop the reinsurance and that they could have renewed on the same terms if the wanted.

Co-founder clarifying intention of reinsurance reduction (X.com)

Lemonade has steep competition across its product lines from traditional insurance companies and up-and-coming insurtech companies. Traditional insurance companies have been slow to adopt digitization, let alone AI, and will likely have difficulty integrating it into their complex and silo’d systems. They may choose to outsource AI models like Palantir, but that comes at a high cost and is less customizable than Lemonade’s in-house solution. Other insurance platforms are arising and may present risk, but it appears that Lemonade is the most established and diversified, with a longer track record and demonstrated technology.

Conclusion

The upcoming Q2 earnings will be critical for the share price and could lead to volatility in either direction. Now that the reinsurance has been reduced, management commentary and guidance will be crucial. It seems likely that LMND may raise guidance and move their breakeven date closer with this change. 30% of the float is currently sold short, which may lead to heightened short-term volatility or a potential short squeeze in the event of an earnings surprise. In my opinion, Lemonade presents an asymmetric long-term opportunity and is in the early innings of capturing a piece of a huge market. The unique business model appeals to younger generations that are less likely to sign policies with major insurance companies. Investors and analysts have been negative on this stock for a long time. It sold off 50% from its IPO price 5 years ago and 80% from its highs in 2021 despite rapidly improving fundamentals and strong growth. I recommend LMND as a speculative long-term buy and will be closely watching the upcoming Q2 earnings to update my thesis. With an enterprise value of $2.5B, Lemonade is still minuscule considering the market size, with potential to grow into a significant global insurance player.